UK/Europe: Savills’ latest research in to the coliving market has found that 51 per cent of European investors plan to be active in the sector, making it the joint third most invested-in living asset class, alongside later living, but behind BTR and PBSA.

During 2022 in the UK, there were 2,000 new beds completed and opened to residents, more than doubling the number of operational coliving beds to 3,422. This trend is expected to continue, says Savills, with a further 4,999 beds currently under construction.

There has been a significant rise in UK coliving pipeline activity since the onset of the Covid-19 pandemic in early 2020. In the five years to March 2020, applications were submitted nationally for 10,520 beds. In the three years since then, plans for a further 12,150 beds have been submitted, showing activity more than doubling and demonstrating the appetite from developers, investors and lenders for the sector.

The total number of coliving beds in the UK, either existing or proposed, is now 25,021, with 3,422 operational and 21,599 in the pipeline. The total size of the sector, combining both operational beds and pipeline, has nearly trebled since 2019.

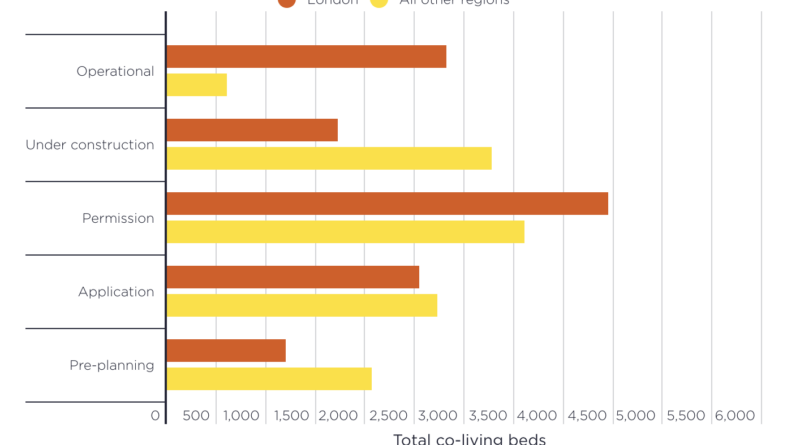

Mirroring the evolution of UK BTR, the emergence of coliving started in London. There are currently 2,820 operational coliving beds in London, accounting for 82 per cent of the total UK market.

But the Savills report points to a surge of growth in the regions: “We are now witnessing an increasing trend of the UK’s regional markets embracing coliving. In fact, we anticipate that the regions will be the main driver of future growth, as there are presently 6,879 beds outside London that are either under construction or have planning consent, which is higher than the 6,176 beds in London. Moreover, the regions have an additional 4,797 beds either at the application or pre-application stage, while London has a slightly lower 3,747 beds at these stages.”

This regional expansion is being driven primarily by investment in the UK’s key regional cities, including Manchester, Sheffield, Glasgow, Birmingham, Bristol and Leeds. These are markets that have already seen high levels of investment into BTR and are home to large populations of the core target market for coliving (young professionals looking for amenities and community). “However, we are also seeing schemes come forward in smaller markets such as Reading, Brighton, Guildford and Kingston, highlighting that coliving isn’t solely the preserve of major cities,” says the report.

Savills adds that as the sector evolves, there is a divergence between the various use class designations that coliving can be operated under.

The C1 coliving model can cater for guests staying for between one and 365 days a year if the appropriate planning permissions are sought to allow stays over 90 days. Having the ability to house residents for less than 90 days is useful, capturing relocation as well as serviced apartment type demand. “It is worth noting however that although rooms can be charged out at a premium for shorter terms, VAT is chargeable on rents under C1.”

The sui-generis shared living model requires a minimum stay of three months on an AST agreement, rather than a licence, and single occupancy rooms that must adhere to design guidelines. The sui-generis model is more widely recognised in planning terms and seemingly preferred if building from the ground-up.

“There are a range of considerations any investor must be aware of when embarking on a Sui Generis, C1 or rarer C3 route to market, namely the different tax, yield, operational and planning regimes. The varied C1 consented model has the potential to offer more immediate access speed to market, through conversions of existing buildings whereas sui-generis shared living schemes can often take longer to get through the planning process,” says the report.

Although there are a relatively small number of operational schemes, interviews with active players in the market show evidence of strong lease-up rates and growing rental values, indicating very strong demand from residents. Both Dandi Wembley and Folk’s Sunday Mills in Earlsfield demonstrate the speed at which schemes can be leased-up. The former leased all of its 360 beds in just three months, an average of four beds per day, while the latter let 315 beds in only four months, and during the typically slower winter period.

ARK Co-Living in Wembley took a measured phased approach to pre-let and post opening lease-up, with the beds being let over a six-month period. As a result, it was also able to achieve excess of 30 per cent growth in rates.

In Q1 2023, Savills and Savills Investment Management surveyed European investors with more than €1 trillion+ of combined assets under management (AUM). The survey found that 38 per cent of those investors are already investing in coliving, making it the joint third most invested-in living sector, alongside senior housing but after multifamily and PBSA.

The survey also revealed that 51 per cent of investors plan to target coliving in the next three years, an increase of 13 per cent and the highest growth rate among all living sectors. A third of those investors targeting the sector said they expect to deploy between €100 million and €500 million by 2025. This equates to a total of €2.6 billion of capital targeting the coliving sector in the UK and Europe over the next three years.

Morgan Scale, associate director, Savills Debt Advisory, said: “Whilst a few years ago lender appetite for coliving was far more selective than for traditional BTR product, this is no longer the case and we are seeing strong demand from both bank and non-bank lenders to finance development and investment opportunities for high quality Sponsors. Lenders have quickly understood that the growth of the sector is reflective of a more permanent shift in resident demand for flexible tenancies and social interaction spaces, and they are keener than ever to provide finance to the sector.”

Savills adds that in providing greater housing options, often to those who have little choice, coliving delivers social mobility and real social value. With their emphasis on shared amenities and resident interaction, the schemes also foster a sense of community and promote wellness. A study by The Collective found that 71 per cent of coliving residents felt that living in a shared community had improved their social life. Coliving has been shown to be particularly appealing to millennials (people aged between 25 and 40), who greatly value the social and community aspects of the lifestyle.

Dandi Wembley also recently conducted a study of its residents using LifeProven, an ESG property consultancy, and 82 per cent of residents said that living in the scheme had improved their quality of life.