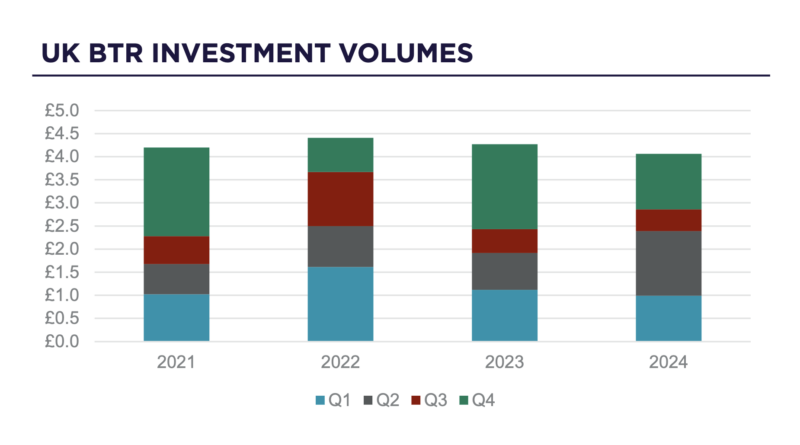

UK: The Cushman & Wakefield report for Q4 2024 found that the BTR sector in the UK attracted £4.1 billion in investment last year, a six per cent dip from 2023.

Despite this, single-family housing (SFR) has continued to gain traction, securing £1.2 billion in investor capital. More than 18,000 new BTR homes have been completed, representing a 17 per cent increase year-on-year.

In Q4 2024, UK BTR investment volumes reached £1.2 billion, with multifamily housing accounting for 80 per cent of transactions. Despite macroeconomic challenges affecting real estate investment overall, the annual total of £4.2 billion was just six per cent lower than the previous year.

Noteworthy Q4 transactions included Starlight Capital’s acquisition of four forward purchase schemes in Manchester, Basildon, and Leeds. Investment in operational assets rose to 28 per cent of total BTR investment in Q4 2024, as more operational stock entered the market, attracting core capital.

Rental inflation eased in 2024, averaging 5.4 per cent across the UK. London recorded a slowdown, with rent growth at just 2.3 per cent, indicating a shift in supply-demand dynamics after years of steep increases. Rent growth has also fallen below earnings growth for the first time in years, slightly reducing income burdens for renters.

Despite regulatory pressures and higher borrowing costs pushing some landlords out of the rental market, property availability has improved, though supply remains below pre-pandemic levels. Although rental stock increased 12 per cent in 2024, it remains 20 per cent below pre-pandemic levels, reinforcing the strain on availability.

The gap between tenant demand and available rental properties remains a central factor. The latest RICS survey showed a decline in tenant demand for the first time since 2020, with Zoopla data revealing a 29 per cent drop in rental inquiries compared to the previous year.

Forecasts predict a 3.9 per cent increase in London rents and a 4.5 per cent rise across the UK.

Regional markets are expected to see stronger growth, while affordability constraints in the capital could limit further rises.

Mark Clegg, Cushman & Wakefield‘s head of UK residential capital markets, said: “From a regulatory perspective, the anticipated Renters’ Rights Bill (RRB) introduces some uncertainty for 2025, with its impact likely to emerge gradually. Additionally, energy performance standards along with higher purchase taxes for private landlords mean the market is unlikely to see much improvement in supply, with BTR a critical component in meeting housing demand.”