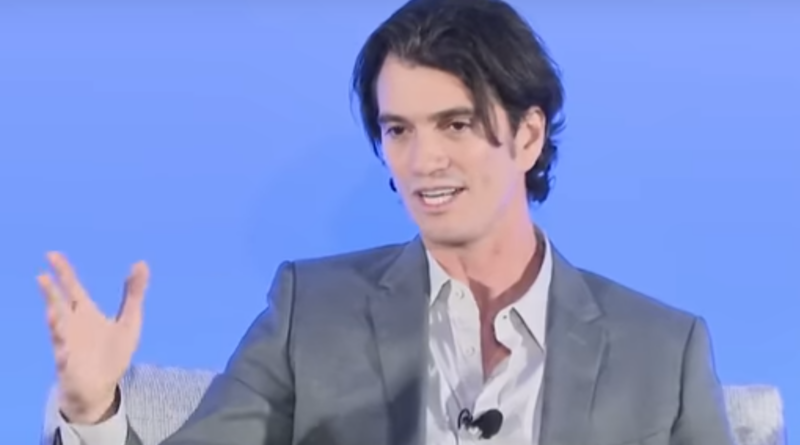

WeWork co-founder Adam Neumann revealed some tantalising details about his new residential venture Flow recently, without giving away its secret sauce.

Following his ousting from WeWork, Neumann embarked on various ventures, including the formation of a family office which acquired 4,000 multifamily apartments in locations such as Atlanta, Fort Lauderdale, Miami and Nashville.

It was while assembling this portfolio that Neumann came to the conclusion that “the residential experience is not what it should be”.

Now with the financial muscle of venture capital giant a16z, which has invested around $350 million in to Flow – reputedly the largest single round of backing in a16z’s history – Neumann is on a mission to reinvent the multifamily experience, and he revealed some details about the venture in a discussion with a16z co-founder Marc Andreessen.

In 2022, more than 70 per cent of under 35s in the US were renters rather than home owners and Neumann believes that figure is going to grow. On average they spend a third of their income on rent “but they are not getting an experience that is up to par, and they are not creating any equity – it’s a real challenge. A lot of things are shifting, and the way we live has an opportunity to change. A great experience is more important than ever.”

Modern multifamily buildings are “a little bit sad”, says Neumann. “They have all these amenity spaces but there’s never anyone there. I don’t think human connection thrives.” Average churn in US multifamily is 50 per cent, with users staying an average of two years.

Neumann says the residential space has never been subject to the branding and intense competition of other industries, competition which inevitably drives up standards. There is a shortage of three to five million apartments and single family homes in the US, depending on whose figures you believe, and that number grows by hundreds of thousands every year.

The supply and demand balance has meant that nobody has needed to do anything differently, says Neumann. “The renter is not getting a good deal – neither the experience or the financial transaction, and that renter is the majority of the young adults.”

Enter Flow, which Neumann says will do several things differently, in order to create a sense of community. Show rounds will include an introduction to residents to get a user’s eye view of the building. “It’s such a natural thing for people who are living together to connect but we live in a world where, even in the same building, they don’t talk to each other in the elevator,” says Neumann.

The ethos of Flow can, he says, be summed up in one sentence: “We want to create an elevated experience for the resident and we want to share with the resident a portion of the value that they create.”

The brand is based around four pillars:

• A branded technology-first management company to run the buildings

• A real estate fund that owns the buildings

• A financial services company

• A mechanism that will create value for the value creators

The first pillar may be based on a similar model to Alfred, a startup that provides apartment buildings with services including concierge staff and software. Indeed it may even be Alfred – the Neumann family investment office, 166 2nd LLC, led a $42 million funding round for Alfred in October 2020.

The third pillar, the financial services company, is an interesting one. It will immediately have a relationship with Flow residents as it will be the entity that collects their rent, and Neumann says it will supply other “meaningful” services which will help residents to achieve “financial wellness”. The company will quickly generate a lot of data on residents and can pitch them appropriate products and services according to their behaviours and life stage.

But it is the fourth pillar that is the really intriguing one, and here Neumann is playing his cards close to his chest.

Neumann described the concept of Flow as a flywheel – “if we can create a better experience in the building, the building performs better and makes a better NOI. If the building makes a better NOI we’ll be able to raise more money and buy more buildings. If we buy more buildings, we’ll be able to run more buildings and have more users in those buildings. Those users are going to start using our financial services.”

He says residents will “not only feel part of something but will actually own part of something”, adding the caveat that “ownership is a very complicated word, especially in this place”.

So what does Neumann mean by creating value for the value creators? It could potentially be along similar lines to Miami-based multifamily management company Orion Haus which claims to be “turning renters into real estate investors”. Orion Haus tenants can earn money when they are travelling via a professional management service which sublets their units on Airbnb, Vrbo and Google.

A more radical option would be a version of the shared ownership offer which has been successful for housebuilders and housing associations in the UK. Tenants buy a share of the property – between 10 per cent and 75 per cent of its market value – and pay rent on the rest. They can take out a mortgage to buy their share or pay for it with savings. They also need to pay a deposit, usually between five per cent and 10 per cent of the share they’re buying.

Shared ownership also includes an option called staircasing – buying more equity in a home as and when you can afford it, and thus paying less rent.

A similar arrangement at Flow would fit with Neumann’s flywheel concept – the company would be generating income above and beyond the rental value of a unit, and this could be used to fund the acquisition of more buildings.

But this may be a step too far for Neumann. According to sources familiar with the venture quoted in The Real Deal, Flow renters will not actually accrue equity in the units, nor will they have the opportunity to buy them — they will remain tenants.

Whatever Neumann’s secret sauce is, and whatever his interpretation of the word “ownership” is in this context, we will hear a lot about it when the recipe is revealed. He is a compelling character who fascinates the media, and when Flow really starts flowing he’ll be hoping it disrupts the multifamily sector in a similar way to WeWork’s seismic impact on the office market.