UK: In its latest quarterly residential report, Cushman & Wakefield has analysed the growing UK coliving sector.

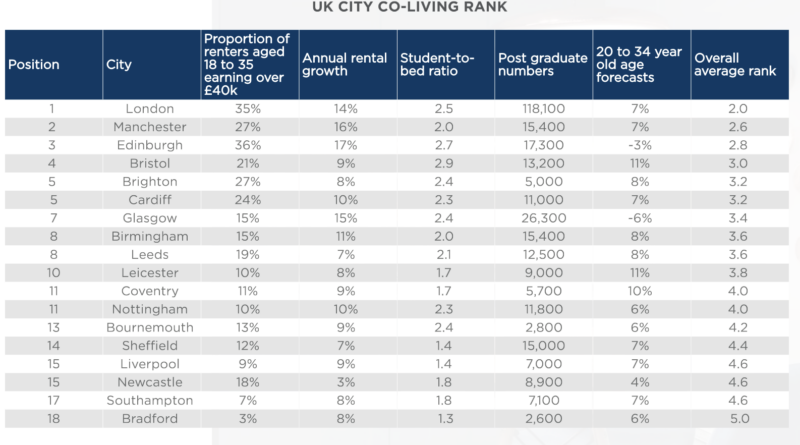

The real estate services company has ranked UK cities in order of their potential for coliving growth. To do this it has considered five factors for each city: proportion of private renters aged 18 to 35 earning over £40,000; PRS annual growth; student-to-bed ratio; post-graduate student numbers; and population forecasts of young adults for 2023 to 2040.

London came out top, ranking as one of the top outperformers for post-graduate student numbers (118,100), proportion of renters aged 18 to 35 earning over £40k (35 per cent), and student-to-bed ratio (2.5). These strong metrics are the reason why London has led the way for coliving. However, these metrics vary greatly by borough – for example, Kensington & Chelsea (60 per cent), Westminster (57 per cent) and Tower Hamlets (55 per cent) having the highest proportion of renters aged 18 to 35 earning over £40k, and Hammersmith and Fulham (12 per cent), Wandsworth (11 per cent) and Tower Hamlets (11 per cent) having the strongest population forecast for young adults between 2023 and 2040.

Manchester was the second-best performer, ranking as one of the top outperformers for proportion of renters aged 18 to 35 earning over £40k (27 per cent) and annual rental growth (16 per cent). However, the student-to-bed ratio in Manchester sits at 2.0 – below the national average – suggesting overspill from the student market for coliving may be lower than in other cities.

Edinburgh is in third position, emerging as one of the leading cities in terms of the proportion of renters aged 18 to 35 earning over £40k (36 per cent), annual rental growth (17 per cent), and the student-to-bed ratio (2.7). Both Glasgow and Edinburgh are robust student markets with high student-to-bed ratios and a substantial post-graduate audience. Additionally, both cities have experienced a significant rise in international students over the past two years. Glasgow has witnessed an influx of 12,600 additional international students, while Edinburgh has seen an increase of 7,100. High levels of international student numbers might help balance the negative growth forecast for young adults in Edinburgh and Glasgow by 2040.

Other cities were ranked in the following order: Bristol, Brighton, Cardiff, Glasgow, Leeds, Leicester, Coventry, Nottingham, Bournemouth, Sheffield, LIverpool, Newcastle, Southampton, and Bradford.

The report says that, alongside these demand metrics, it is important to consider land availability, planning, build feasibility and affordable housing agreements. These factors will have a major influence on where the coliving market will evolve. For example, as things stand, coliving is unlikely to evolve in Liverpool due to the city council’s decision to view coliving in the same way as the private rental market. Coliving in Liverpool has to comply with housing policies such as minimum space standards, lease lengths longer than six months, more two-bedroom apartments provided than one-bedroom, and so on. London planning is not straightforward either. The GLA published The Large-scale purpose-built Shared Living Guidance LPG, which aims to give guidance around applying the H16 policy. However, there is still a lack of consistency across boroughs, with some more in favour of coliving than others.

In terms of stock, London is leading the way with 2,300 complete coliving units. Key players in London are Folk (Sunday Mills, Palm House, and Florence Dock), The Collective (Canary Wharf and Old Oak Common), Mason + Fifth (Italian Building), Ark (Wembley Ark) and Node (Brixton). According to Molior there are 2,400 coliving units under construction and 5,600 in planning (applications and permissions).

Deliverability of these pipeline schemes will vary, with construction and debt costs sky high, as well as a complicated planning process for those without permission. Similar to the BTR market, the coliving trend is extending beyond London and gaining traction in various regions. Manchester’s coliving pipeline is leading the way for the rest of the country with 1,700 co-living units under construction and 970 units in planning (applications & permissions) (Urbinfo). There are several notable complete coliving schemes in the regions: Zinc Works in Bristol, The Gorge in Exeter, Scape in Guildford, and Vonder Riverside in Leeds.

The report concludes: “Overall, the investor rationale for coliving is strong and there is growing interest from investors. Like all real estate sectors, the cost of debt and a changing construction environment is temporarily dragging on the pace of investment. This, alongside planning issues such as minimum space standards and affordable housing delivery. With few operating coliving assets in the market, coliving relies heavily on forward funding deals, so investment in today’s environment is limited. As the cost of debt eases, the market adjusts to recent changes in building regulations, and planning regulations become more clear, coliving investment is forecast to rise rapidly.”

To read the full report, click here.