UK: Knight Frank’s NextGen Living 2025 report reveals institutional investors are planning to deploy £45 billion in the UK’s living sectors over the next five years.

The research, based on insights from 56 institutional investors managing more than £60 billion in UK living assets, shows that by 2029, nearly a quarter plan to double their current exposure, with close to half targeting at least 80 per cent increases in allocation.

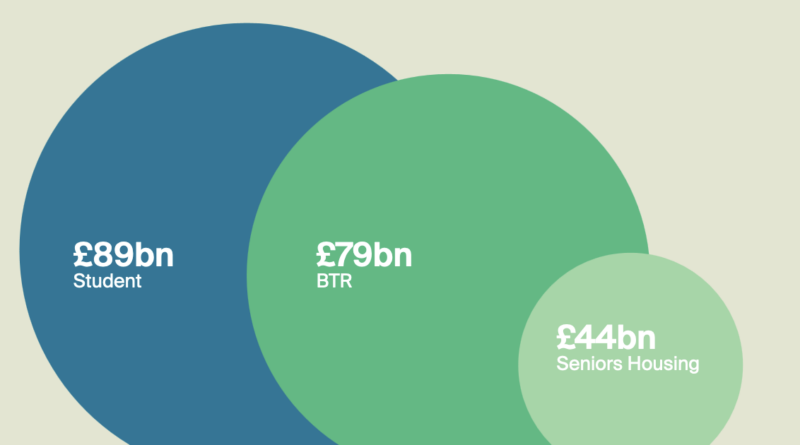

The research breaks down the current market value of the living sector (£212 billion) in to its sub-sectors. Knight Frank estimates the current market values of the PBSA market to be £89 billion, BTR £79 billion, and seniors housing £44 billion. For context, the industrial sector is valued at £283 billion, retail at £271 billion, and offices at £263 billion.

Oliver Knight, head of residential development research at Knight Frank, said: “The UK’s living sectors have experienced a significant transformation over the past five years, with the total value of the market increasing by 45 per cent over that time as established players expand, and global newcomers look to capitalise on the opportunity. Growth hasn’t been without challenges, but the future is bright. Our research confirms investors continue to see a compelling case for investing in assets that benefit from changing ways of living and which provide strong counter-cyclical features that can help them achieve consistent returns.”

According to Knight Frank, investment into UK Living Sectors reached £10 billion in 2024, accounting for around a quarter of overall real estate acquisition activity. Robust investment has continued despite a challenging investment market, reflected by a shift in the types of deal structures investors are targeting.

James Mannix, global head of living sectors at Knight Frank, said: “The living sectors continues to demonstrate remarkable resilience and growth. The fundamental drivers – migration, urbanisation, aging populations, and increasing student numbers – are all structural tailwinds that bridge economic cycles. We’re seeing investors not only deepening their exposure to established segments, but also strategically expanding into emerging areas like Seniors Housing and Single-Family Housing. Our research indicates that by 2029, 30 per cent of the investors surveyed in this year’s report, expect to be invested across all Living Sectors.”

The research shows investor appetite for high growth sub-sectors is set to surge, with the proportion of investors targeting seniors housing rental expected to nearly double from 21 per cent today to 39 per cent by 2029. Similarly, exposure to single family housing is projected to increase substantially, with the proportion of investors rising from 41 per cent currently to 71 per cent by 2029.

Knight Frank’s survey of leading investors points to key urban centres as strategic investment targets, with London, Bristol and Manchester emerging as the top three locations across the Living Sectors. Other prominent locations for investors in the top 10 include Birmingham, Edinburgh, Bath and Oxford.

Environmental and social considerations are increasingly influential in shaping investment strategies. Investor pressure has emerged as the primary driver, with 81 per cent of respondents citing this as a key factor in their ESG investment decisions. In development priorities, EV charging infrastructure leads new project requirements, with 66% of investors targeting this feature. Additionally, sustainable energy solutions are gaining prominence, with just over half of investors focusing on heat pumps and solar power generation in their developments.

The research points to improving market conditions heading into 2025. Construction cost inflation has shown significant moderation, falling to 2.9 per cent in 2024 from its peak of 15.5 per cent in 2022, with further stability anticipated as interest rates continue their downward trajectory. The investment landscape has also evolved, with joint ventures emerging as the preferred route to market over traditional purchase of stabilised assets, reflecting adaptation to current market conditions.

Lisa Attenborough, head of Knight Frank capital advisory, added: “Despite the recent volatility in the bond market, we’re seeing remarkable confidence from commercial real estate lenders. Recent landmark deals by Blackstone and Goldman Sachs underscore this confidence in the market’s potential. Leveraged buyers are also returning to the market, as some 42 per cent of investors told us that they plan to increase their debt exposure in the coming year.”