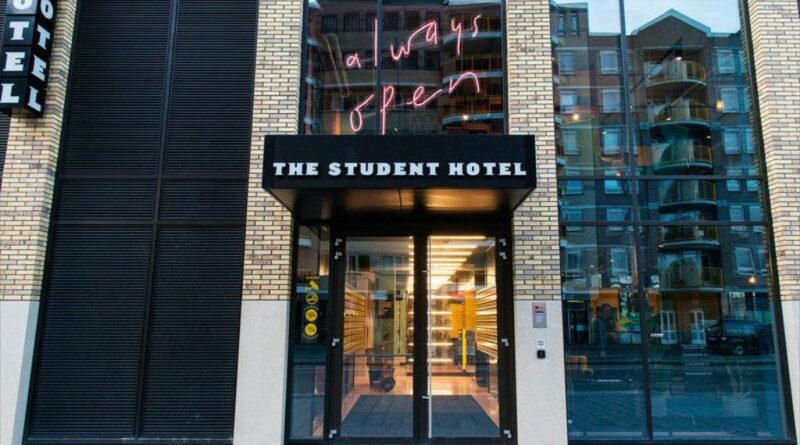

Netherlands: Singapore sovereign wealth fund GIC and Dutch pension manager APG have reached agreement to buy “a substantial stake” in The Student Hotel (TSH).

The partners, who acquired their stake from Aermont Capital, will commit to invest in further expansion for the hybrid hospitality company, subject to customary regulatory approvals. The transaction values The Student Hotel, including assets currently under development, at €2.1 billion.

The deal sees APG and founder Charlie MacGregor increase their current stake in TSH. APG first invested in TSH in 2015. MacGregor and Aermont Capital entered into business in 2014 after MacGregor opened the first The Student Hotel in 2012. GIC now joins as a new investor.

TSH’s hybrid hospitality model combines student accommodation, hotel rooms, coworking and meeting spaces, bars and restaurants. During the pandemic the hybrid model proved resilient as TSH was able to substantially increase room allocation towards students when leisure and corporate travel dramatically reduced, thereby achieving strong occupancy rates and remaining cash-positive. With the hotel and travel market rebounding strongly, TSH is set to benefit from a strong summer while its student bookings for the 22/23 academic year already stand at record levels.

With APG and GIC’s commitments, TSH will be able to accelerate its growth strategy to expand into key European cities and grow its presence to 50 hotels, from the 25 hotels under ownership today, of which 15 are currently operational and three are opening in 2022, in Madrid, Barcelona and Toulouse.

Charlie Macgregor, founder and CEO of The Student Hotel, said: “We are very excited to welcome GIC on board, and together with APG, we look forward to bringing The Student Hotel experience to more cities across Europe. We have bold plans and the additional committed capital will allow us to be even more ambitious. I’m very grateful for Aermont being alongside us since 2014, for what has been an amazing journey to where we are today. With our hybrid hospitality model, we have become a game-changer for the hospitality industry and have a major growth platform to welcome more guests to our hotels.”

Lee Kok Sun, CIO of real estate at GIC, said: “We are pleased to invest in The Student Hotel as its assets are well-located, enjoy good connectivity to city centres and transportation networks, and are in close proximity to universities and other amenities. We are confident that this investment will generate resilient long-term returns.”

Robert-Jan Foortse, head of European property investments at APG, added: “We are excited about the opportunity to increase our exposure to TSH, and to support the further growth of the platform. We want to thank Aermont for all of its efforts over the past years, and for being a great partner. Together with GIC, Charlie McGregor and the rest of the TSH team we are looking forward to further expand TSH’s unique hybrid and exciting concept across Europe. We are convinced that TSH will provide an attractive long term, stable investment return for our pension fund client ABP, and its participants.”

Morgan Stanley acted as financial advisor to TSH, Aermont Capital and APG. Allen & Overy acted as legal advisor to Aermont. Loyens & Loeff acted as legal advisor to TSH.