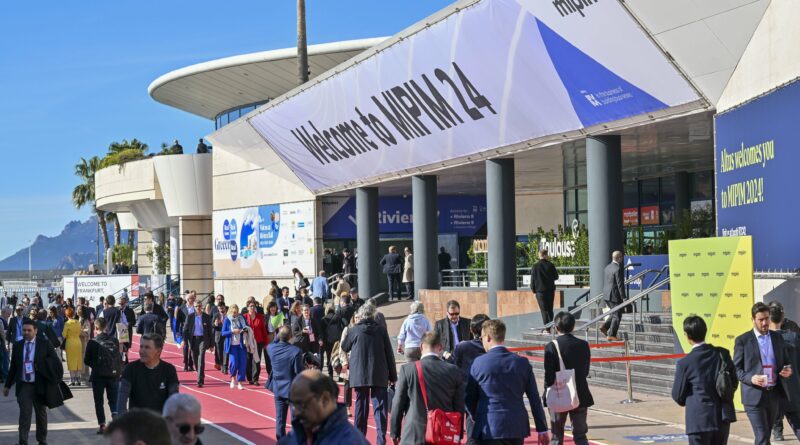

ULN editor George Sell reports from MIPIM in Cannes, where the living sector has reached the top of the real estate agenda.

The living sector, often overshadowed by other asset classes at MIPIM, Europe’s flagship property investment event, came of age in 2024. The housing shortage and how to address it was discussed in numerous sessions at the Cannes gathering, which featured a dedicated one-day event – Housing Matters! – taking the Monday slot.

Amid the super yachts and opulent corporate hospitality, it was at Housing Matters! that Michal Mlynár, United Nations assistant secretary-general and acting executive director of UN-Habitat, gave a sobering insight in to the increasing pace of urbanisation and how it is exacerbating housing issues globally.

By 2050, urban areas will be home to nearly seven billion people, highlighting the undeniable trend towards urban living, said Mlynár, with 1.5 million people worldwide moving to cities to improve their opportunities every week.

While city growth is slowing, low-income countries will see a significant urban population increase by 2070, necessitating careful planning to avoid issues such as urban sprawl and housing inadequacy.

Urbanisation correlates with economic growth but also with increasing inequality, said Mlynár, who pointed out that urban sprawl and declining densities may lead to increased carbon footprints and strain on infrastructure.

Perhaps the most startling statistic he revealed was that 2.8 billion people globally are experiencing inadequate housing, with around 1.1 billion residing in informal settlements. To address the issue a build rate of 96,000 houses a day would be needed.

As if to ensure that the housing shortage could not merely be thought of in abstract terms, as the discussions were taking place, an anti-MIPIM demonstration was being staged outside the venue. Amid a heavy police presence protestors were holding banners claiming that MIPIM and its attendees were responsible for driving up property prices and rents, making housing unattainable for low income families.

Another of Mlynár’s observations was that youth migration to cities drives demand for rental housing, and it was this phenomenon that was discussed in a panel in the London pavilion, looking at BTR and coliving in the capital.

The discussion initially looked at the burgeoning SFR space. L&G’s Dan Batterton said: “The demand for SFR has always been there but the houses haven’t.” The BTR sector, and particularly SFR, is countercyclical compared to the housing for sale market and should build a stability of demand for housebuilders, he added.

Batterton also alluded to something of a sea change in UK attitudes to rental and home ownership, saying that in an L&G survey of residents with an average age of 30, two-thirds said that wouldn’t buy a home at that point in their lives, even if they could.

He also claimed that the environment “is the biggest priority for our customers”. “They have asked us very complicated questions about carbon use,” he said. The environmental performance of homes has never been under more scrutiny – in an earlier presentation, Anna Moore, CEO and co-founder of retrofit specialists Hestia pointed out that housing is responsible for 18 per cent of global CO2 emission, and that 40 million European households are living in fuel poverty.

Batterton concluded the session with two bullish assertions about the strength of the residential and BTR markets specifically. “Pension funds should have 20 per cent of their funds dedicated to residential assets. At the moment it’s much lower than that,” he said, while claiming “BTR will be the best performing real estate asset class in the UK over the next five years. The demand for new homes will not be met in my working life.”