UK: Cushman and Wakefield‘s latest quarterly UK residential insight report highlights investor sentiment to BTR.

The report explores the makeup of the BTR sector, investor intentions, priorities, and opinions for 2024.

It represents a view from 32 leading institutional investors – a mix of those who plan to enter the sector, and those who already own 49,000 operational BTR units and 28,000 pipeline BTR units between them.

The value of investors’ UK BTR portfolios shows the market being dominated by several main players, with 36 per cent of investors owning a UK BTR portfolio worth more than £1 billion. Conversely, 61 per cent of investors have much smaller portfolios, worth anything between £20 million and £500 million, the newer players to the market.

Portfolio size is slightly more spread out, with only 16 per cent of investors owning a portfolio with more than 5,000 operational BTR units and only 12 per cent of investors owning a construction pipeline of more than 2,500 BTR units.

The pipeline analysis shows that the supply-demand imbalance within the rental sector isn’t going to be solved any time soon, with the surveyed investor sample bringing forward just an additional 28,000 BTR units in the next couple of years.

The type of operators investors use to manage their portfolio is fairly evenly split, with 50 per cent using an in-house platform, 46 per cent using a third party manager and four per cent using a combination of third party and in-house. For those opting to use a third-party manager, 46 per cent use a mix of operators. This is likely to be down to a lack of available operators with the experience and scale to cover all geographies and product types.

Two-thirds (66 per cent) of investors said their preferred predominant type of UK BTR deal structure was the same as the deal structure they expect to use in 2024.

Forward funding came out top, with 34 per cent of investors selecting it as their preferred deal structure, of which 82 per cent of those investors noted it as their expected deal structure in 2024. Forward funding has and will continue to be investors preferred deal structure due to its risk profile and the opportunity to build scale quicker. In 2023, viability challenged forward funding, and although investor appetite is strong, 2024 will most likely see variations to the standard forward fund structure in order to be able to close deals.

The joint second preferred route to the market was forward commit/purchase, with 19 per cent of investors stating it as their first preference, and of those investors, 67 per cent expect it to be their primary deal structure in 2024.

Stabilised stock also came joint second, with 19 per cent of investors noting it as their preferred deal structure, however, of those investors, 83 per cent expected their deal structure to actually be forward fund, forward commit or direct development in 2024. Investors are realistic about the limited stabilised stock opportunities in the BTR market, as well as constraints of older stock, for example fire safety, sustainability and cladding.

Just 13 per cent of investors said direct development with planning risk, and six per cent said direct development without planning risk, was their preferred route to market. The perceived inefficiency of the UK’s planning system, changing building regulations, construction costs and time to practical completion are cited as reasons for this.

For those investors whose preferred dominant deal structure was forward funding, 60 per cent said their preferred unlevered IRR was 10 per cent. For those who preferred forward commit, 50 per cent said their preferred IRR was between 10 and 11 per cent. For stabilised stock, 80 per cent of investors said their preferred unlevered IRR was between seven and eight per cent. There was a real mix of targeted IRRs for direct development (with or without planning risk), with a range between nine and 14 per cent.

Other key findings from the survey include:

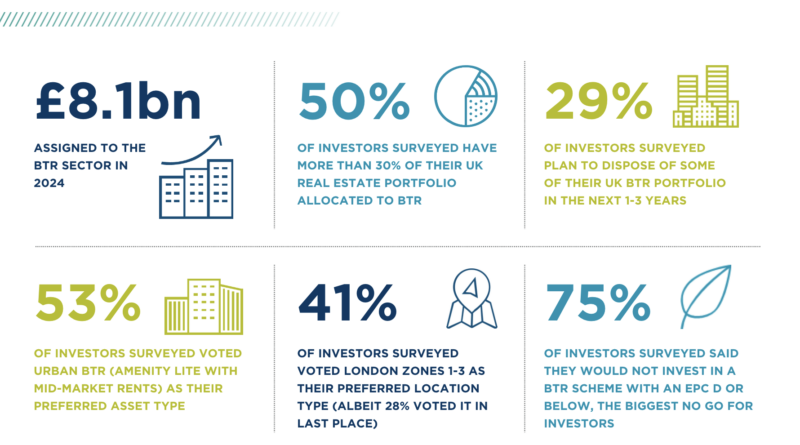

• £8.1 billion will be assigned to the BTR sector in 2024

• 50 per cent of investors surveyed have more than 30 per cent of their UK real estate portfolio allocated to BTR;

• 29 per cent of investors surveyed plan to dispose of some of their UK BTR portfolio in the next 1-3 years

• 53 per cent of investors surveyed voted urban BTR (amenity-light with mid-market rents) as their preferred asset type;

• 41 per cent of investors surveyed voted London zones 1-3 as their preferred location type (albeit 28 per cent voted it in last place)

• 75 per cent of investors surveyed said they would not invest in a BTR scheme with an EPC D or below, the biggest no go for investors